What I'm working on now is a low exposure system that can be used to trade CFDs at 10% margin. Exposure is a measure of time in the market and thus a measure of risk, and I think this is the ideal way to trade using margin because it can minimise drawdowns to a great extent.

The aim of the system from the beginning was to restrict all trades to a holding time of just one day. This is what allows for the low exposure and low drawdowns, since you are not holding overnight. So I'm in at the open and out at the close. Initially I looked at intraday stops but they cannot be tested (properly) without intraday data, are more prone to slippage, and require more precise execution and possibly even screenwatching!

Because I want to trade at 10% margin, the maximum acceptable level of system drawdown was 2%. This is sort of already swinging for the fences as it is. One of the things I have learnt over the last 18-24 months is that systems are always traded outside the parameters they are tested in. Always. And the maximum of drawdown of any system is yet to come. But I must admit, having been through a time where there was unprecedented volatility in the markets does give me an increased level of confidence.

The system I'm describing in this post actually begun initially as two separate systems, one long only and the other short only. They traded over different universes and the long system did actually outperform the short system in almost every measure of performance and risk, but when combined, the result was better than the long one alone in terms of CAR/maxDD (my preferred measure of risk-adjusted return), mostly due to the increase in trade frequency.

Another thing I wanted in this system is to have it designed in a way to avoid situations where I have to "choose" between candidates. And because they both trade small universes from the ASX50, and for obvious reasons long and short entries tend to not trigger on the same day, I was able to allocate capital in such a way to make this possible.

The system (both long and short components) methodology is mean reversion and based on work by James Altucher published in his book "How to trade like a hedge fund: 20 uncorrelated strategies", albeit with a few variations.

I'm well aware of the pitfalls of mean reversion, and I heed Jerry Parker's words with caution:

"Mean reversion works almost all of the time. Then it stops and you're kind of out of business. The market is always reverting to the mean except when it doesn't. Who wants a system like we have, "40% winners, losing money almost all the time, always in a drawdown, making money on about 10% of your trades, the rest of them are sort of break even to losers, infrequent profits? I much prefer the mean reversion where I have 55% winners, 1% or 2% returns per month. "I'm always right!" I'm always getting positive feedback. Then, maybe in 8 years, you're kind of out of business, because when it doesn't revert to the mean, your philosophy loses."

The main problem with mean reversion is how long it takes to revert back to the mean and how much pain will you have to endure. With this low exposure system, win, lose or draw, I'm out by the close.

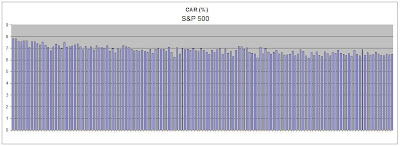

Above is system statistics as given by AmiBroker, with the testing done over 10 years from 01-01-1999 until 31-10-2008. As you can see from the exposure, it spends most of its time, OUT of the market.

I'm still deciding which stocks to include in the universe when considering trading practicality. Obviously If I buy a stock of which 20% of the opening volume is my order, I will influence the opening price. This has cut my trading universe down and thus my returns significantly, but that's okay. The main thing is that I design something that can actually be traded.