Sunday, May 1, 2011

Friday, April 1, 2011

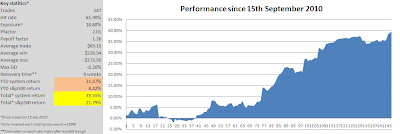

Six months in

+8.53% for March and +27.57% for the first quarter. We've hit the 6 month mark so I've added a few more charts.

While results have been promising, I would expect the payoff ratio to even out over time and the hit rate to edge closer to 70 than 60%.

On March 15th, IB's margin risk controls didn't seem to kick in so I found myself holding 21 positions, well beyond my maximum of 5 or 6. So I just closed all positions (out of panic) 3mins into the session and ended up +$1499 for that day.

Monte carlo analysis shows that performance for March 15th, had the number of positions been restricted as per the system, could have been anywhere between -$200 and +$2258 depending on which stocks I bought, with the median being $799.

So while the broker error didn't leave me much to complain about(!), it did show that automated trading systems still need monitoring. Especially if your system buys weaknesss and you can see the futures are down 2% in the pre-open!

Friday, March 25, 2011

Correlation between volatility and performance

As a system (AGT is what I call my system) that trades intraday, its no surprise that it performs well in times of volatility where the intraday range expands, which is what typically happens during bearish times.

So it has got a bit of an insurance mechanism built-in to protect from Black Swans. But unlike the techniques employed by funds like Universa, AGT is not too shabby during uptrends either.

The peak of the GFC, which is from September 15th 2008 (Lehman Brothers collapse) until March 9th 2009 which was the bottom, when the VIX went crazy, is also the time AGT went nuts, and tacked on 83% in under 6 months.

Tuesday, March 1, 2011

Saturday, February 12, 2011

Tuesday, February 1, 2011

Wednesday, December 1, 2010

RYAAY and performance thus far

I have noticed that this system trades RYAAY a fair bit more and disproportionately compared to the percentage of the stock universe this ticker represents (I trade about 50 stocks).

Looking at the chart, it's not hard to see why. RYAAY does like to gap around.

Overall, while the performance so far for the last two and half months is unlikely to lead to an onrush of investors wanting me to trade their money, the system has so far been performing in line with expectations.

This system, by design, thrives on intraday volatility. The more volatility there is, the better it performs. As we all know, intraday volatility is the highest in bearish times. In makes much more moderate profits in times where the market is slowly going up.

To illustrate this, let's look at 2009 performance.

From 1st March to 31st December the general market rose almost 50%.

My system in that time "only" returned 27%.

However, in January and February, where the market fell about 10% per month, the system made 30%+ in each of those months.

Note that I only include the market performance for the purposes of comparison. It is not a benchmark we are trying to beat. To make -5% when the market is -20% is not a good year for me. I aim for absolute returns.

Subscribe to:

Posts (Atom)