Tuesday, December 16, 2008

Monday, November 17, 2008

Sunday, August 24, 2008

Portfolio Update 22/08/08

Saturday, August 16, 2008

Portfolio Update 15/08/08

Tuesday, August 12, 2008

Sunday, August 3, 2008

Saturday, July 26, 2008

Portfolio Update 25/07/2008

Sunday, July 20, 2008

Monday, July 14, 2008

Monday, July 7, 2008

Friday, June 27, 2008

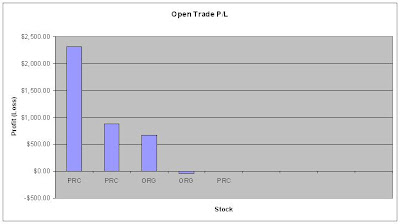

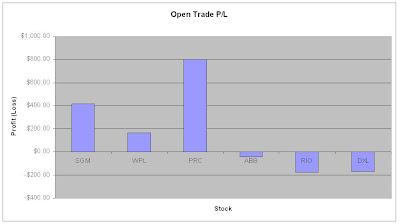

Out with a bang!

This is the last update for this financial year and the dollar gain marks my best week yet.

RIO and ABB have triggered exits.

The proceeds will go towards pyramiding my positions in WPL and ORG.

Starting from next year, I will put in a performance summary on my weekly updates, to make it easier to monitor the system's performance.

It's worth mentioning that I have noticed some divergence between the market performance and the system performance the last 6 weeks as per the attached chart.

Welcome 2008-2009, lets make this one a big year!

Saturday, June 21, 2008

Friday, June 13, 2008

Friday, June 6, 2008

Saturday, May 31, 2008

Portfolio Update 30/03/2008

Saturday, May 24, 2008

The one that got away

The whole reason I got into systems testing and design is to answer the elusive question - how much (profit) do you give back in order to ride the longer term trend?

With CEY (shown above), it's obvious the exit was too tight.

But that's okay -- I'm interesting in using the exit which works best MOST of the time, over hundreds of different trades and over long periods of time.

There will always be exceptions, but you have to be willing to let those go, and move on to the next trade.

But congrats to anybody who caught this one, its a real winner.

Friday, May 23, 2008

Friday, May 16, 2008

Percent risk and Profit

The other week I did a few TradeSim simulations on my system to see the relationship between risk and returns.

As the graphs show, from a pure profit perspective, 2.5% fixed percent risk per trade delivered the best results.

But if you want to consider the risk undertaken to make the return, as I do, then the system which position sized using 1.5% fixed percent risk per trade was on top.

Saturday, May 10, 2008

Saturday, May 3, 2008

Subscribe to:

Posts (Atom)